Employer-Sponsored Retirement & Savings

Simple, worry-free retirement savings options for employers and benefit managers.

Recent trends suggest 60% of non-retirees have little or no comfort in managing their investments.* Pension Fund invests on our members’ behalf and provides the expertise, resources, and support necessary to protect them physically, spiritually, and financially. With over 14,000 members and more than $3.9 billion in assets, rest assured we’ll not only manage but securely grow your employees’ retirement savings.

94%

Employer Satisfaction Rating**

Why Choose Pension Fund?

Experience the Pension Fund difference:

- Personalized service via dedicated Area Directors.

- Variety of complementary products for flexibility in benefits packages.

- No fees charged for management or net returns.

- Competitive, guaranteed base interest rates.

- Additional interest and credit earnings (awarded to all members) when excess reserves exist.

Benefit from being part of a "Church Plan":

- Nonprofit financial ministry with a calling to serve you (not our own pockets).

- Exempt from ERISA administrative requirements and costs.

- Values-driven approach to investing that informs investment policy and guidelines.

- Partnership with the Interfaith Center on Corporate Responsibility (ICCR) to ensure socially responsible investing.

- Plans enable ministers to take advantage of housing allowance in retirement.

Help your employees achieve long-term financial wellness:

- Free financial consulting, tools, and education courses (via “Your Money Line”) available to all members.

- Death, disability, spouse, and dependent benefits available for Pension Plan participants.

- Security in knowing that for over 125 years, none of our participants has ever experienced a reduction in pension or loss in retirement accounts due to poor market performance.

- Conservative investment approach and consistent funding levels allow us to remain strong even in times of economic uncertainty.

Discover why our investment strategy means better benefits.

Learn MoreExplore Our Employer-Sponsored Products

Pension Plan

The Pension Plan is a defined benefit plan that guarantees a monthly payment for life for a member (and spouse/qualified domestic partner). This product also offers the security of built-in death and disability benefits in the event a worst-case scenario becomes reality. Total dues are 14% of gross salary which is used to provide two types of benefits:

- An annual pension paid monthly in retirement (11%)

- Death & disability coverage prior to reaching retirement (3%)

Dues can be split between you and your employer, or your employer may opt to fund the entire 14%. Retired ministers may also declare housing allowance on their monthly pension distribution in retirement.

Tax-Deferred Retirement Account 403(b)/Roth 403(b)

The Tax-Deferred Retirement Account 403(b)/Roth 403(b) (TDRA 403(b)/Roth 403(b)), is a defined contribution employer-sponsored retirement savings plan that allows eligible employees to set aside a portion of their compensation on a pre-tax basis and/or on a Roth (after-tax) basis to save for retirement. Employers may make contributions to the pre-tax TDRA 403(b) as a benefit for the employee. By contributing to a 403(b), participants are able choose a savings strategy that fits their plans for retirement based on how they want to be taxed.

457(b)

The 457(b) Plan is a deferred compensation retirement plan for members who want to make additional retirement plan contributions in addition to a TDRA 403(b) plan and/or Pension Plan, deferring compensation and decreasing tax liability.

The 457(b) Plan is offered to the following eligible employers: college, universities, seminaries, benevolent care centers, and non-steeples. Employees: Check with your employer to see if the 457(b) Plan is available to you.

What Our Employers Are Saying

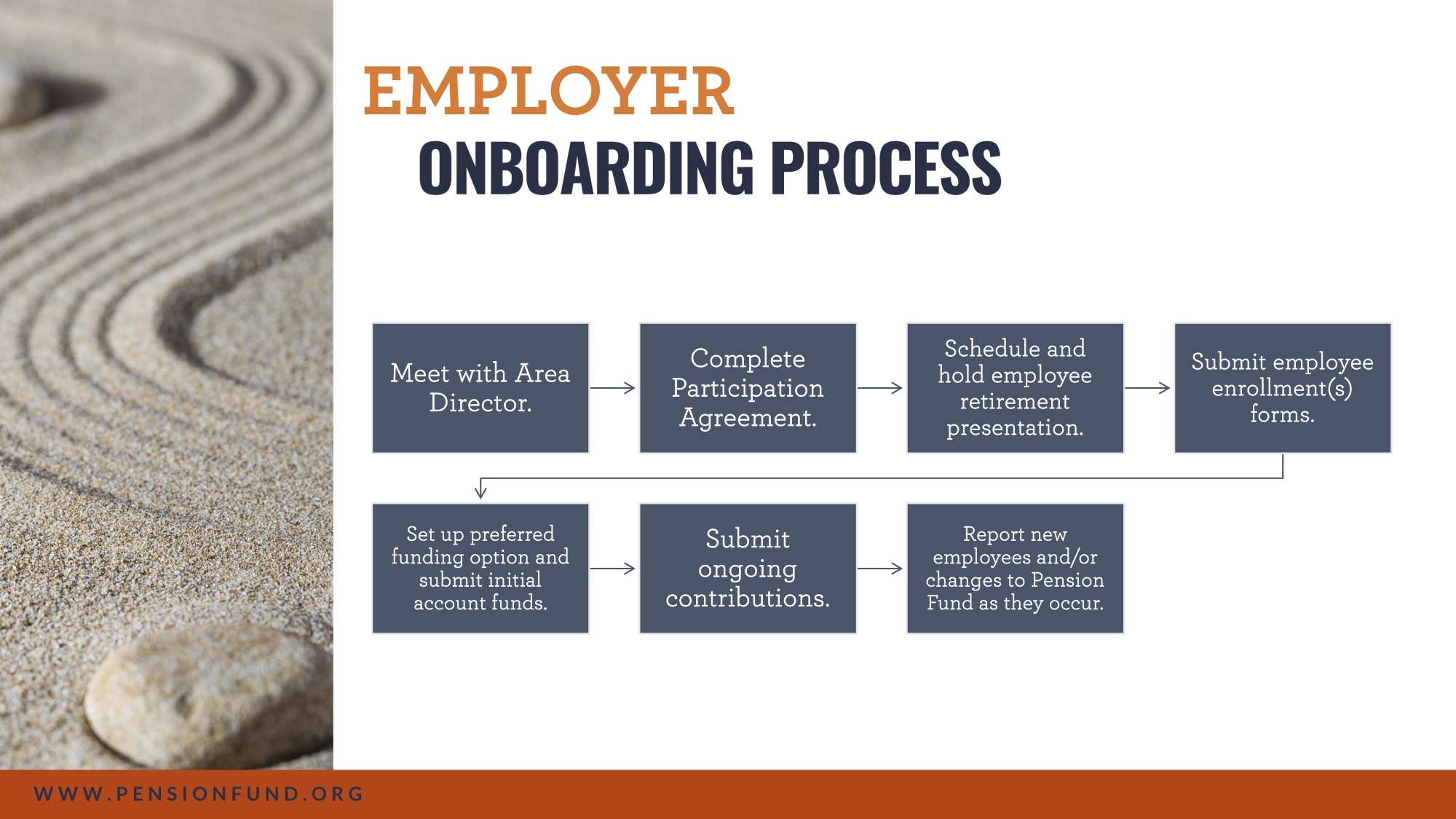

What to Expect:

*Source: US Federal Reserve, Report on the Economic Well-Being of U.S. Households in 2018, May 2019. https://www.federalreserve.gov/publications/files/2018-report-economic-well-being-us-households-201905.pdf

**Based on responses of employers who answer satisfied or very satisfied on Pension Fund's 2022 Annual Employer Satisfaction Survey.